Typical street scene in Santa Ana, El Salvador. (Photo: iStock)

IMF Survey: Putting Financial Globalization to Work

August 16, 2007

Financial globalization is here to stay and all countries, essentially, are affected by it to varying degrees.

Construction in Dubai, UAE, where real estate is booming after being opened to foreign investment (photo: Karim Sahib/AFP)

INTERNATIONAL CAPITAL FLOWS

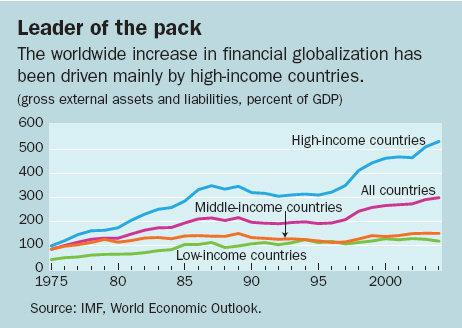

Advanced countries have seen the most rapid increases in financial flows over the past two decades, but emerging markets and developing countries have also become financially more integrated (see chart).

Even those countries that have sought to "lean against the wind" of financial globalization by maintaining extensive capital controls have seen some increase in the size of their external assets and liabilities.

Key Points

The issue: Is financial globalization primarily an opportunity to share risk internationally and finance investment projects that are good for growth or is it a source of possible volatility and crisis?

Policy considerations: While opening up to FDI at an early stage is likely to benefit all countries, a decision to liberalize short-term debt-creating inflows should take into account a country's financial market development, perceived institutional quality, and macroeconomic policies. But delays in opening up also carry costs.

Policy implications: Capital account liberalization should be pursued as part of a broader reform package encompassing a country's macroeconomic policy framework, domestic financial system, and prudential regulation.

Should financial globalization, defined as the extent to which countries are linked through cross-border holdings, be viewed primarily as an opportunity for countries to finance investment projects that are good for growth or as a source of possible volatility and crises caused by sudden reversals in capital flows? What have we learned from research on these topics over the past few years? A paper prepared by IMF staff in the Research Department, entitled "Reaping the Benefits of Financial Globalization," takes stock of what we know about the effects of financial globalization.

Data from the past 30 years reveal two main lessons for countries to consider.

First, the findings support the view that countries need to carefully weigh the risks and benefits of unfettered capital flows. Whereas advanced economies largely benefit from the free movement of capital, emerging market and developing countries should make sure they meet certain thresholds—which include the quality of their institutions and policymaking and their level of domestic financial development—before they open up their capital account. If they do not meet such thresholds, financial liberalization can lead to macroeconomic volatility.

Second, there are also costs associated with being overly cautious about capital flows. Opening up the economy to outside investment may in itself encourage changes that are good for efficiency and growth, for instance by stimulating development of the domestic financial sector.

Effects of financial globalization

In theory, opening up the economy to investment from abroad should have largely positive effects. Financial globalization encourages international risk sharing, stabilizes spending by households and the government (by allowing international capital to supplement domestic capital when there is a shortfall of revenue), and fosters economic growth.

In practice, however, the benefits have been less clear-cut. Although advanced countries have benefited from risk sharing, there is little evidence that the same is true for emerging market and developing countries. As international financial integration has increased so has volatility—but only in those countries with relatively weak domestic financial sectors and institutions.

In terms of growth, the evidence is also mixed. Whereas FDI does encourage long-run growth (our paper shows that an increase in FDI of 10 percentage points of GDP increases growth by 0.3 percentage points on average), the impact of debt on growth depends on whether the money is put to good use, which in turn is influenced by the quality of a country's policies and institutions.

The study's analysis identified a number of factors that are likely to be involved in the effect of financial globalization on economic volatility and growth.

• Financial sector development. Well-developed financial markets help moderate boom-bust cycles that are triggered by surges and sudden stops in financial flows.

• Institutional quality. Strong institutions—including the rule of law, freedom from corruption, and government efficiency more generally—play an important role in directing financial flows toward FDI and portfolio equity. A sound institutional framework thus makes it easier to share risk internationally and supports economic growth.

• Sound macroeconomic policies. If macroeconomic policies are weak, financial openness may result in excessive borrowing and debt accumulation, thereby increasing the risk of crisis.

• Trade integration. Countries that are open to trade are less likely to experience sudden stops in inflows and current account reversals. Openness to trade can also mitigate the effects of a crisis by facilitating economic recovery.

The study also found that financial globalization does not seem to make countries more vulnerable to crisis. In fact, crises are, if anything, less frequent in financially open economies than in economies that restrict capital flows. Our estimates also show that financially open countries with well-developed domestic financial systems, strong institutions, sound policies, and open trade have an even lower risk of experiencing a crisis.

Capital controls no free lunch

While countries should proceed with caution when it comes to opening up their economies to capital flows, policymakers should also bear in mind that keeping capital controls in place can impose significant costs on the economy. These include

• Lower international trade. There is ample evidence showing that capital controls encourage fraud through mis-invoicing. And new research suggests that capital controls increase the cost of engaging in international trade even for firms that do not seek to evade capital controls.

• Higher cost of capital. Capital controls make it more difficult and expensive for small firms to raise capital. The cost of borrowing is also higher (about 5 percent on average) for multinationals located in countries with capital controls than in countries without them.

• Distortions in the economy. Economic behavior is likely to be distorted by capital controls as individuals and firms seek ways to evade the measures. This may result in an uneven playing field in which well-connected firms—rather than the most efficient ones—survive.

• Administrative costs. The government has to spend significant resources on monitoring compliance with capital controls and on updating them to close loopholes and limit evasion.

What, then, do these findings entail for the advice the IMF gives to member countries? In general, capital account liberalization should be pursued as part of a broader reform package encompassing a country's macroeconomic policy framework, domestic financial system, and prudential regulation. In particular, long-term, non-debt-creating flows, such as FDI, should be liberalized before short-term, debt-creating inflows.

Our empirical results broadly support this approach. Opening up to FDI is beneficial for almost all countries, even those with relatively weak fundamentals. But before liberalizing other types of flows, countries need to carefully consider whether they meet the thresholds beyond which the net benefits of financial globalization become positive.

In sum, all countries should aim to embrace financial globalization. But before opening up their capital account, governments should examine the readiness of their financial sector and their level of institutional development. At the same time, they should also weigh the possible risks involved in opening up to capital flows against the efficiency costs associated with capital controls.

Looking ahead

While a cautious approach to liberalization remains warranted when domestic fundamentals are weak, the net benefits that countries can derive from financial integration are likely to become more substantial in the future.

First, markets are moving toward a more equity-based structure, which tends to have a beneficial impact on international risk sharing and economic growth.

Second, many emerging market countries have reformed their economies in recent years, bringing them up to the thresholds where the benefits associated with financial globalization begin to outweigh the risks.

These developments should make it easier for countries to reap the benefits of financial globalization in the years ahead.